Everything You Need to Know About Open Enrollment for 2024-25

Published May 1, 2024

Open enrollment is an important time that comes just once a year. It’s the period in which you make changes to your health plan elections without a qualifying event like marriage, divorce, loss of other coverage, adoption, and the birth of a child.

Whether your employer is offering a new health plan (medical, dental or vision hardware) or even if there is nothing new, it’s important to review your benefit offerings to make sure you’re optimizing the health care benefits that best fit your and your family’s needs.

Open enrollment is YOUR opportunity to make sure each elected health benefit fits your care needs.

Here’s a guide to help you stay on track this plan year:

1. Get the latest information.

1. Get the latest information.

- Check with your employer to find out if there will be an in-person or virtual open enrollment meeting offered. These are hosted by a SchoolCare Group Relations Specialist and provide a great opportunity for live Q&A.

- If you can’t attend a live meeting, watch the 2024-25 Open Enrollment Webinar for an overview of benefits and updates.

- Familiarize yourself with the plan options your employee offers. This includes your medical plan(s), as well as dental and/or a vision hardware benefit for contacts and glasses if applicable. Your group-specific plans can be found here. Use the drop-down menu to choose your employer and see the plans available to you.

- Read through the 2024-25 Enrollment Guide to understand all benefit options available through the SchoolCare/Cigna medical plans.

2. Determine What Will Work Best for You and Your Family

- Reflect on your health expenses for the last year. What kind of coverage might you and your family need for the upcoming plan year? If your employer offers multiple plans from which to choose, consider the monthly cost out of your paycheck as well as overall out-of-pocket costs when comparing options. Review our health plan webinars if trying to determine which is best for you.

- Does your employer offer a Flexible Spending Account (FSA)? You can have pre-tax dollars set aside to pay for your health-related expenses. If you were previously enrolled with an FSA keep in mind you must re-enroll each year. The money you set aside must be spent each year, or you may lose it come July 1st.

- Now is a good time to start looking at spending any remaining funds for 2023-24. If you have a grace period or rollover as part of your FSA, you do have extra time to spend any remaining funds. Check with your HR office if you need to find out more about your specific FSA guidelines.

- If you are on the Orange plan, or are considering electing it, you qualify for a Health Savings Account (HSA) and your employer may contribute to it as well. An HSA rolls over from year to year, you own the account and the funds never expire. It can be used to pay for health-related expenses and certain over-the-counter products, and money spent from your HSA annually is eligible for tax benefits.

- Did anyone in your family start or stop wearing glasses? You may want to enroll in or change your VSP hardware plan if offered by your employer.

3. Take action. Enroll for the first time or update your elections

- Gather dependent information (this includes spouses and children), including social security numbers, dates of birth, addresses, emails, and phone numbers.

- Click here to access your group-specific Benefit Summaries and Enrollment/Change Form.

- Complete your Enrollment/Change Form and submit it to your HR office by your employer’s deadline.

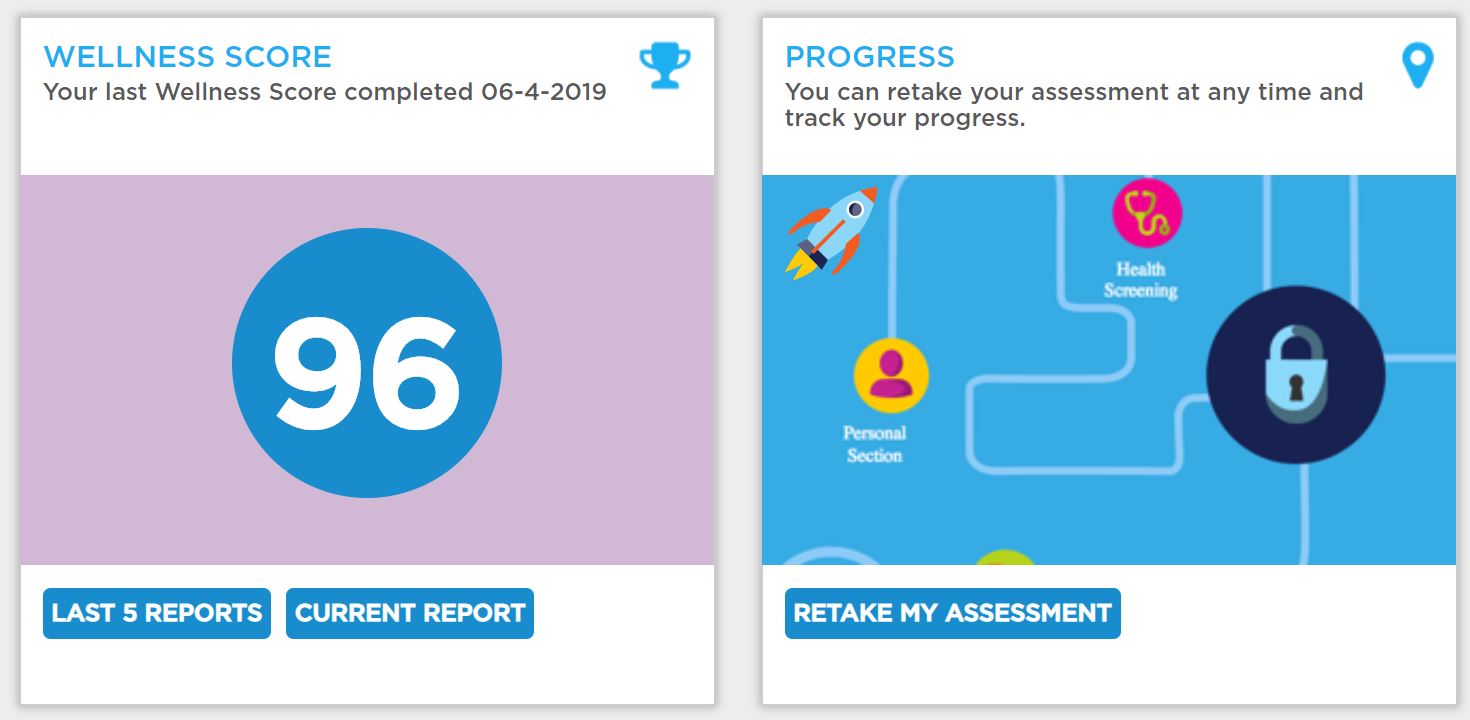

- Set a reminder to complete your confidential Health Assessment at myCigna to earn Good For You! Well-Being Program incentives and activate your Choice Fund, if applicable.

- All Yellow Plan with Choice Fund subscribers must complete the health assessment annually to unlock your Health Reimbursement Account (HRA), also known as the Choice Fund. Health assessments for the new year can be completed beginning June 1.

Still have questions?

Changes you make, or do not make, during open enrollment last for an entire year. If you need assistance, don't hesitate to ask.

- For questions about benefit changes or forms contact your HR department

- For specific medical or dental coverage questions contact Cigna at 800-244-6224

- For additional general coverage and benefits questions, call SchoolCare at 603-836-5031 and press 3.