The Pulse of SchoolCare

Tools to manage out-of-pocket health costs

Updated April 29, 2024

When it comes to managing out-of-pocket health care costs, understanding the tools available to you is key. Flexible Spending Accounts, Health Reimbursement Accounts and Health Savings Accounts are great options to help pay for planned health expenses.

Health Reimbursement Account (HRA)

An HRA is funds in an account that your health plan or employer owns and contributes to. HRAs are available to employees on the SchoolCare/Cigna Yellow Plan with Choice Fund. The Choice Fund is an embedded HRA. When activated, it provides $1,000 for a single plan and $2,000 for a 2-person or family plan. This fund helps cover the first portion of services that apply to your deductible. To activate funding of the HRA, subscribers must complete an annual Health Assessment at myCigna.com. Click here for more details.

Note: On the SchoolCare/Cigna Yellow Plan with Choice Fund plan? Check with your employer to see what benefit options are available to you.

Flexible Spending Account (FSA)

An FSA is a great cost savings tool to help pay for out-of-pocket eligible medical, dental, vision and hearing expenses using pre-tax dollars. If your employer offers an FSA option, here are some advantages of enrolling this plan year:

- Increase your spendable income by reducing the amount you pay in taxes

- Easily budget the cost of planned yearly health care expenses

- The full elected funds are available on the 1st day of the plan year

- Use your FSA benefit on eligible dependent expenses

Learn more about the FSA benefit.

Health Savings Account (HSA)

Like an FSA, this is a great tool to help pay for out-of-pocket eligible medical, dental, vision and hearing expenses, however per IRS requirements, you must be enrolled in a high-deductible health plan - in SchoolCare's case, on the Orange Plan, to qualify to open one. If you are enrolled in the Orange Plan or are considering it, here are some benefits of an HSA.

- You and your employer can contribute to the account up to the IRS-determined annual maximum. Check with your employer to see if they deposit a portion of your yearly max contribution.

- It's a tax-free account - You aren’t taxed on money your employer contributes and you may be able to have your contributions deducted from your paycheck pre-tax. You also do not pay federal taxes on interest earned or withdrawals for qualified medical expenses.

- Funds do not expire. Any funds you contribute to your HSA are yours until you spend them. The balance rolls over year-to-year and

- Even if your spouse and children are not covered by your high-deductible plan, your HSA can be used to cover expenses incurred by you and your dependents.

- You own the account. You may only contribute to it if you are enrolled in a high-deductible insurance plan, but you can continue to spend the money in the account on qualified expenses as needed, even if you change jobs or retire.

Learn more about HSA accounts.

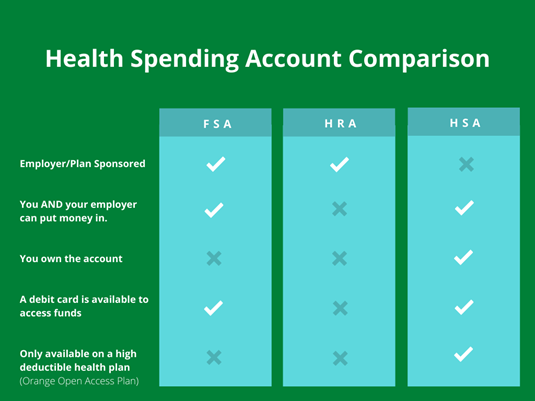

Not sure which is best for you? Here is a quick comparison chart:

As open enrollment season continues, don’t forget to consult with your employer to see what options are available to you. Visit your group specific enrollment materials page to review more benefit options.